Looking Back, Moving Forward: The Alternative Protein Funding Landscape

“The most reliable way to predict the future is to create it.”

– Alan Curtis Kay

The alternative protein sector seems to be getting pummelled from every direction. Investment in the sector is taking a beating with the economic meltdown. Plant-based food sales, especially plant-based meat retail sales, are down, with inflation creating an additional headwind to consumer trial and acceptance. Public companies in the sector are trading at historic lows from their high-flying IPOs while suffering challenges ranging from their supply chain to quality to demand. Consumers are signalling dissatisfaction with the taste and texture of plant-based products and are questioning their nutritional benefits. It’s no wonder we are hearing phrases such as ‘queasy investors’, ‘plant-based struggles’, and ‘re-brand required’ about the current state of affairs. All this is leading people to ask whether the best days of the sector are behind us.

The mood is radically different from a year ago, when companies were flush with capital and investors saw unlimited potential for the sector. Venture capitalists have greater access to dry powder at this point than ever before – $290 billion1 to be precise – yet seem reticent to deploy it. In this article, we take a walk down memory lane, examine our present situation, and peer into the crystal ball for what lies ahead in alternative protein investments. To aid our analysis, we have examined PitchBook data to review companies funded to date2 in the alternative protein sector.

The Golden Age

Alternative protein companies have received $14.2 billion in funding to date. The interest from investors may have ebbed in the near term, but the progress to date has been significant:

Plant-based technology has been the clear leader with 45% of the funding, followed by fermentation at 39% and cultivated at 16%. Plant-based has enjoyed a first mover advantage, but recent funding trends have placed investor hopes in the fermentation and cultivated technology stacks to create products consumers will love.

Building consumer brands has taken priority over creating a robust supply chain. 82% of funding went to B2C companies, with B2B companies garnering just 18%. There remains a huge gap in the supply chain, which if addressed, could supercharge product innovation and as a result, consumer adoption.

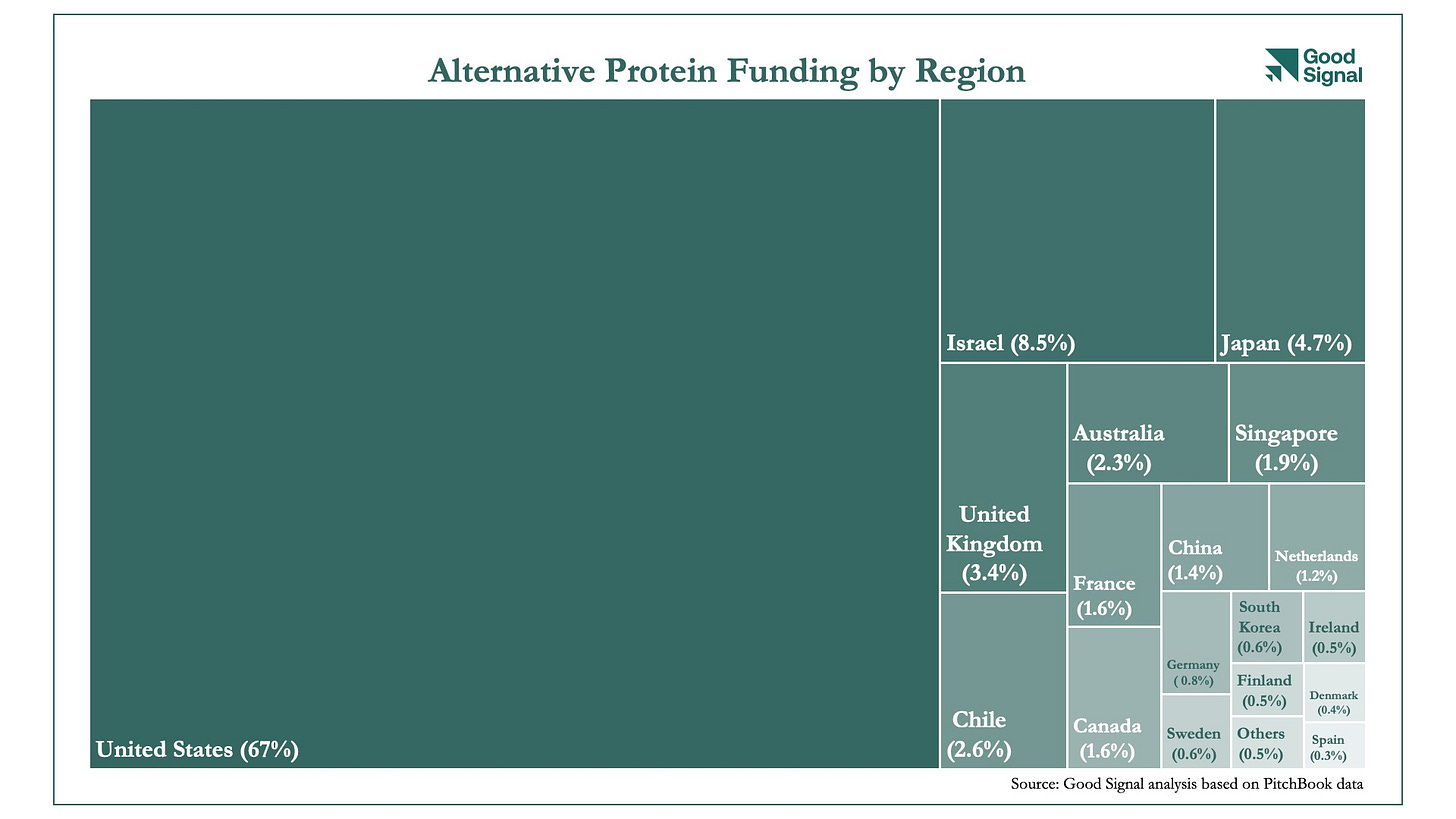

The U.S. has remained the dominant recipient of funding at approximately 8x the size of the next largest country (Israel), which is in turn almost twice the size of the next one (Japan). These three regions have collectively garnered over 75% of total funding.

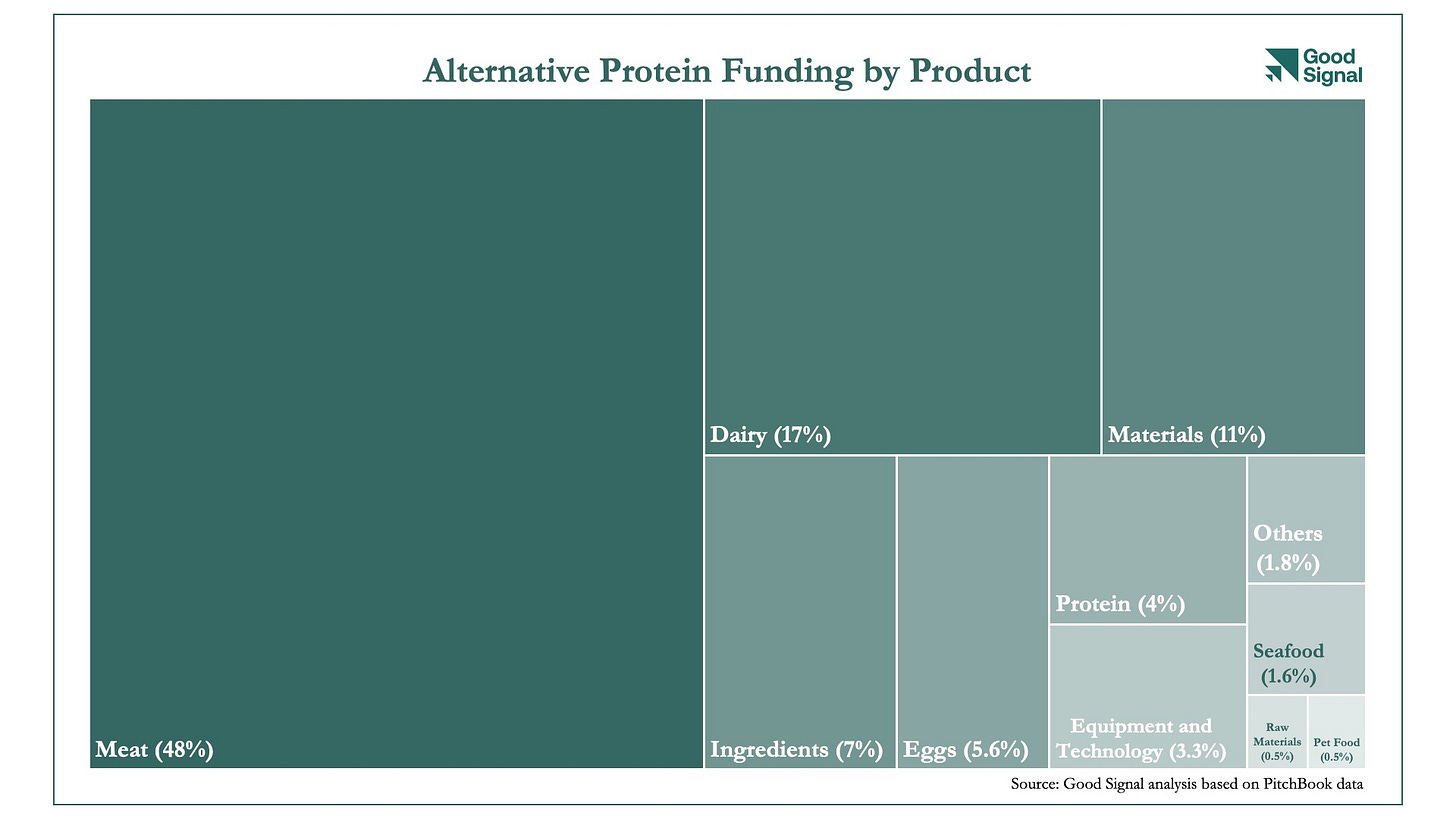

Finally, from a product perspective, we see that the funding rounds are still very much dominated by meat at 48%, with dairy trailing behind at 17% and materials at 11%. The funding for infrastructure (equipment & technology), seafood and raw materials remains scant by comparison.

Alternative proteins had a watershed funding year in 2021 with $5 billion raised across 258 deals3, representing a staggering 35% of all funding received by the sector to date. By comparison, during the same period, agri-food received $51.7 billion in funding across 3,155 deals4, biotechnology saw $46.9 billion in funding across 1,238 deals5 and climate technology added $39.2 billion in funding across 605 deals6. To put things into perspective, while $5 billion was a milestone for alternative proteins, it was still only a tenth of the funding across each of these related sectors. Still, a 60% jump in Y-o-Y funding for the sector signalled its coming of age and raised the expectations from the industry.

A Dose of Reality

2022 has been anticlimactic to say the least. The alternative protein sector has raised just $2.2 billion through the third quarter. The downward trend in funding has been exacerbated last quarter, which saw a paltry $420 million in funding for the sector, a decline of 51% from Q2 20227. This eclipses even the drop in total venture funding during this period, which stood at 34%8. Cultivated meat has borne the brunt of the pain, with just $27 million in funding during Q3 2022. Further, the onset of inflation, immense supply chain hiccups and the ongoing Russian invasion of Ukraine have intensified the issue of food security. The result has been food shortages all over the world, causing cascading price increases which in turn have muted consumer demand. Beyond Meat and Oatly, the twin flagships of the alternative protein industry in the public markets, have stock prices that are trading at a market capitalisation of just 2x sales (down from over 30x+ sales since their IPOs).

According to PitchBook, the alternative protein sector comprises of less than 1,000 funded companies, of which, just 126 companies are leading the charge with investments above $10 million – a small startup pool for an industry touted to be over a $1 trillion by 20509.

To some, the current condition of the industry bears an uncanny resemblance to the dot com bubble of 2000. Back then, investors enthusiastically and speedily backed internet startups, leading to monumental funding levels and stratospheric valuations. In the ensuing gold rush, the role of conventional investment metrics and profitability measures took a back seat. As reality set in, inflated valuations and overhyped products gave way to startups seeing plummeting valuations, a cash crunch and bankruptcy. However, it is important to recognise what followed the dot com burst. Most of the companies we know today – Google, Meta, TikTok, Airbnb – were either invented or rose to prominence after the downturn. Challenging times create conditions where only the strongest companies survive. With the evolution of the industry, new entrants see opportunities to bridge emerging gaps, armed with both learnings from the previous era and a better toolset to handle unforeseen circumstances. Put another way, it is still early. History shows us that many of the companies that will be the winners in the alternative protein sector a decade from now have likely not been started yet.

A New Normal

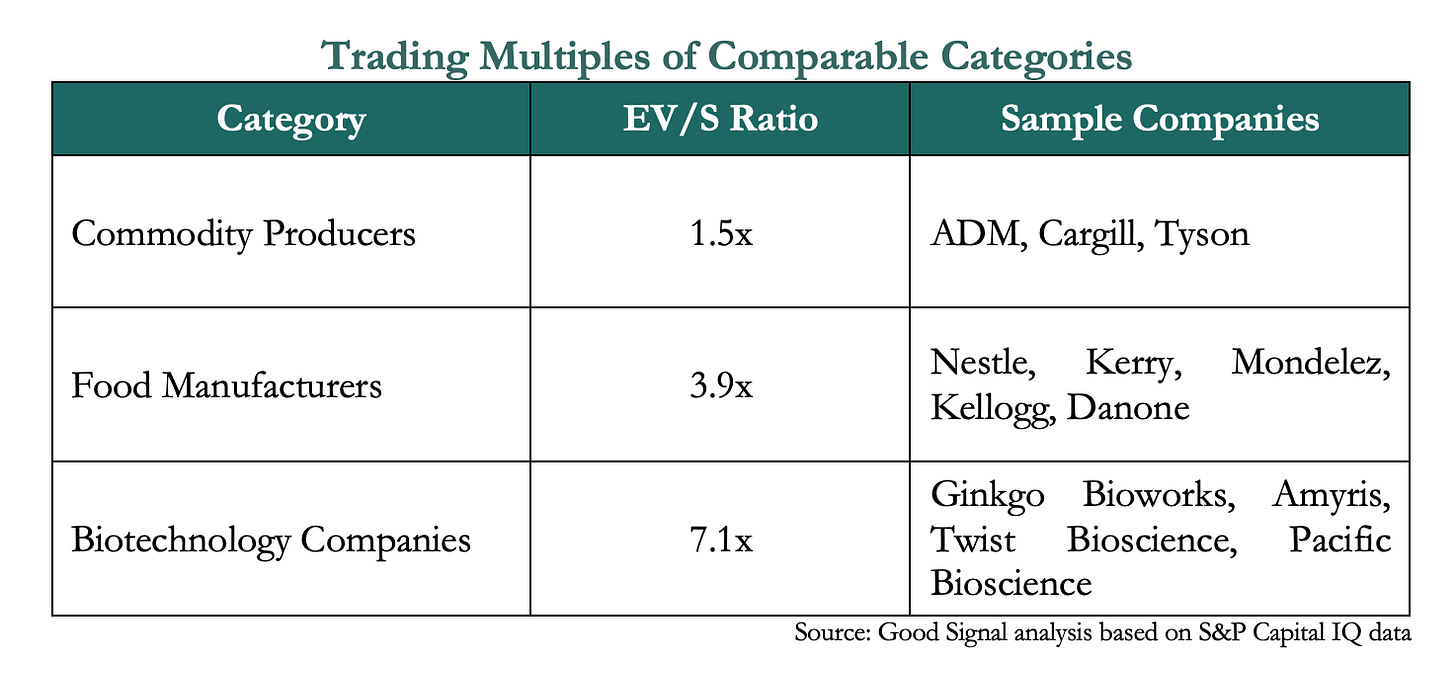

The alternative protein sector is often referred to as ‘food-tech’. That is, it falls at the intersection of food and biotechnology sectors. To better understand the valuations of alternative protein companies, we reviewed the Enterprise Value to Sales ratio (EV/S)10 of companies across three related categories – commodity producers, food manufacturers, and biotechnology companies. EV/S compares a company’s total worth to its sales. Simply stated, an EV/S of 4x means that a company is worth $40 million if it is generating revenues of $10 million. Here are EV/S ratios of categories comparable to alternative proteins:

We see that commodity companies on average are trading at EV/S ratios of 1-2x, food companies are trading between 3-5x, whereas biotech companies are trading at an average EV/S ratio of approximately 7x. Depending on the growth rate and prospects of a given company in each category, it may be at the low or high end of the range. If the valuation of alternative protein companies are grounded in reality, they should be trading at similar multiples as they go public. While earlier stage startups typically get funded at much higher multiples because they are on an accelerated growth trajectory, startups should be prepared to converge to comparable trading multiples as they mature.

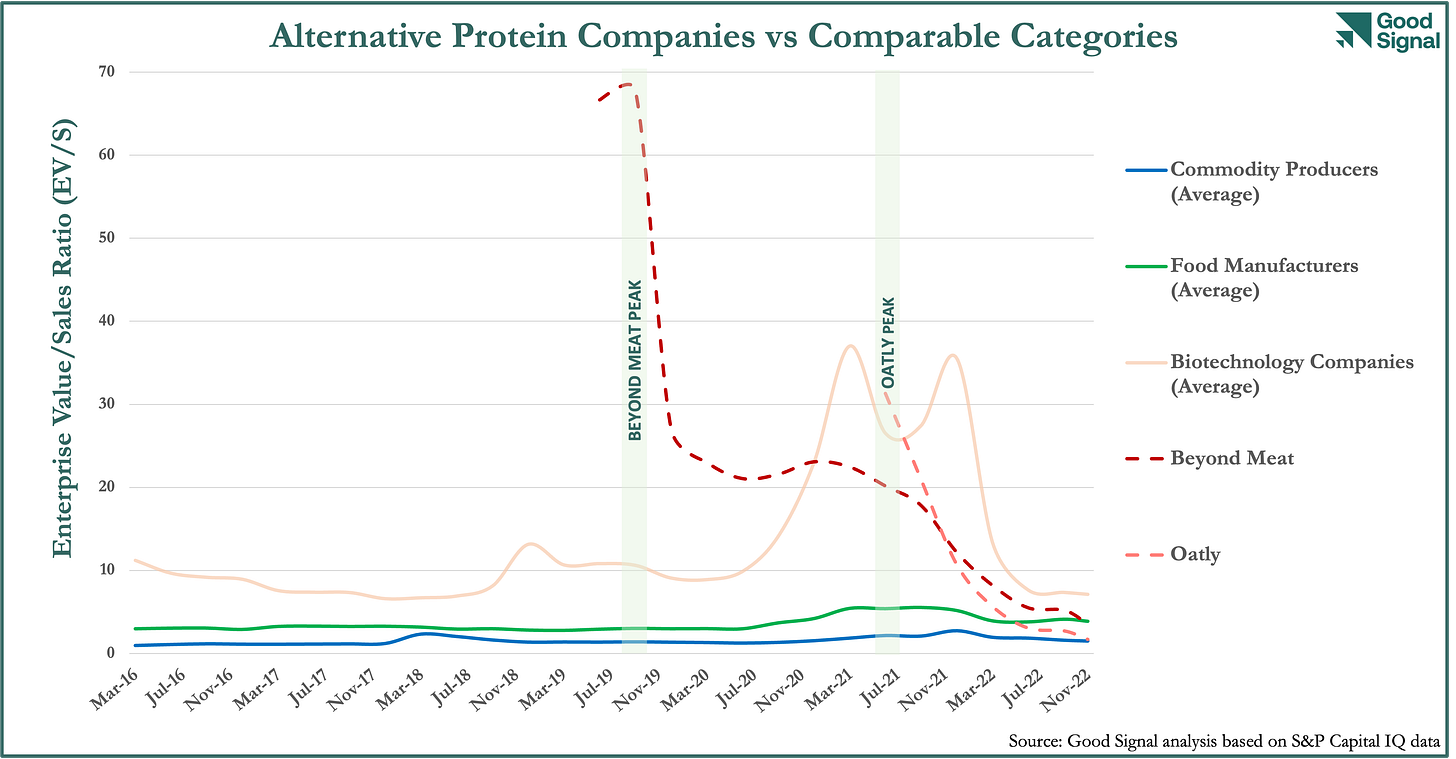

Next, we charted how the EV/S of these three categories changed over the past five years through the recent economic exuberance and the subsequent downturn, and compared them to the EV/S of Beyond Meat and Oatly, the two most visible public companies in the alternative protein sector.

From this chart, we see that the trading multiples for food companies have stayed steady through the change in economic conditions, while biotech companies saw immense interest over the past two years, with EV/S ratios peaking at nearly 37x before trending back down to their previous levels in 2019. Following their IPOs, Beyond and Oatly both listed at trading multiples which were manyfold the levels at which other food and commodity players were trading. In fact, their listing multiples were much higher than those commanded by biotech companies, which also have higher growth trajectories. The EV/S ratio for Beyond Meat and Oatly have since seen massive corrections with Beyond Meat currently trading at 3.6x and Oatly trading at 1.7x. The correction has brought their trading multiples to be much more in line with their public counterparts of similar categories mentioned above.

The Light at the End of the Tunnel

As painful as a market downturn may be, it has the benefit of bringing ecosystem players back to fundamentals. Innovation in the sector continues to thrive. It is also hard to downplay the incredible progress the industry has made in a short time. The recent FDA approval of cultivated meat for UPSIDE Foods was a milestone whose impact is difficult to overstate. This has two major implications for the industry. First, it clearly signals the intent of the U.S. government to bring cultivated meat to consumers. As a result, several other companies who are in advanced stages to receive approval will no doubt follow in the coming months. Second, the U.S. is a bellwether for other regulatory agencies around the world who have been watching closely and are expected to follow with approvals in their markets. This could create a cascading effect leading to increased consumer awareness and open new markets around the world to these companies.

Lower valuations provide opportunities for investors to meaningfully participate in companies, foster deeper relationships with entrepreneurs and conduct deeper due diligence to find high quality companies. The build-up of dry powder within venture capital funds, which is at an all-time high, will put pressure on them to step up their deployment pace, so we should expect the investing activity to pick up next year. However, to keep the investor ecosystem engaged, alternative protein companies will ultimately need to see exits. At that point, the company must demonstrate fundamentals that will be attractive to its acquirer or to public markets. And to do so, alternative protein companies will have settle at valuations that are justified based on the trading multiples of similar comparable categories. Until we have a sizeable representation of public alternative protein companies, the benchmarks will be driven by adjacent industries such as food and biotechnology. Entrepreneurs who build their companies with this in mind will see the most interest from investors and other ecosystem players.

Harvard Business Review

All time alternative proteins funding data as at 24 November 2022

The Good Food Institute (GFI)

AgFunder AgriFoodTech Investment Report 2021

Crunchbase News

ClimateTech VC (CTVC)

PitchBook

CBInsights State of Venture Q3’22 Report

ClimateWorks Foundation, accessed via GFI

Enterprise Value (EV) measures a company's total value taking into account both the company's equity and debt and is often used as a more comprehensive alternative to equity market capitalisation. Enterprise Value to Sales (EV/S) is a financial valuation measure that compares the EV of a company to its annual sales.